The EU referendum result came as a surprise to some, but after the inevitable maelstrom in the media debating the market fallout, what are the more rational and likely effects this referendum result will hold for the UK in the short and medium term horizons? SWL provides it’s considered insights on this important legislation.

Economic Situation

As you know, following the result of the referendum on Friday 24th June, the pound fell to its lowest levels since 1985, $2 trillion was wiped off the global economy and UK had its credit rating reduced. The pound dropped lower still on Monday 27th June and after rallying a little, fell to a new 31 year low on 5th July following the suspension of trading by 3 commercial property funds. The suspension of trading allows properties to be valued and then traded upon correctly, instead of rush sales which devalue the entire fund. A further 3 funds have also put a hold on trading amid news that foreign banks will no longer lend on London properties and businesses are threatening to relocate to other EU cities.

Economists have cut estimates of UK GDP growth by 0.5% to 1.4% for 2016 and 1.7% to 0.4% for 2017. The US and German 10-year bonds have dropped to their lowest levels in 31 years; US Central Bank may lower interest rates to contain damage to the US economy. Calls have been made for interest rates to remain the same in UK & US – the level of confidence this would demonstrate would help to reassure that both currencies can weather the current storms they are experiencing.

The Bank of England is calling for Britain to be prudent. Rules for banks have been eased, which will allow them to continue lending for mortgages and businesses. The FTSE 250 has fallen sharply, particularly construction companies which experienced a large slump in activity prior to the referendum. The FTSE 100, which is more internationally focused companies, has rallied far more. The rapid appointment of a new Prime Minister has provided reassurance for market share values. The political stability has helped improve the FTSE 100 & FTSE250 as well as the value of the Pound compared to both US Dollar and the Euro.

Economic Impact

The uncertainty of the outcome of UK/EU Brexit negotiations has caused much turmoil in the economy. Preparations have been made by some; others are finding it a shock.

All will be watching the negotiations over UK’s exit from EU. Some companies, such as HSBC and Vodafone, have announced plans to move their headquarters to other EU countries in the next 2 years; anticipating the increased costs of importing cars, Jaguar Land Rover has announced new manufacturing jobs in one of their UK factories.

An agreement along the same lines as Switzerland may be the outcome of UK’s exit negotiations. Switzerland was hailed as one of the beacons for post-EU Britain to mirror, which with their strong economy is a reasonable aim. The strength of the Swiss economy is on the whole attributable to the lack of government intervention. There have been large changes in the political hierarchy due to the shock of the referendum result, there may be changes in how the UK government handles the economy, but it is unlikely the changes will be that big…

Primark is expecting a decline in profits in UK, but their European stores and the relative increase that will bring to the overall sales, will offset any decline in UK income. Stores operating in US and Europe as well as the UK may benefit in this manner, so the impact of the fall in the pound will be lessened in company-wide profit margins.

Imports

Energy prices are predicted to rise as gas, electricity and crude oil are all traded internationally in US dollars. Gas prices are generally agreed 3 months in advance, with some suppliers allowing customers to fix their prices for a year, so the impact of price increases may be limited. There have been increases of 2.6p per litre at the pump for petrol already due to the disparity for crude oil prices. The importance of domestically produced energy is heightened, with EU subsidies still accessible for sustainable energy projects; it is likely there will be an increase in supply from renewables, which will also help customers with their electricity bills.

Clothing lines and prices are agreed at least until Spring collections next year, Summer collections 2017 are likely to be the point at which the prices are increased. Next has announced their prices are secured until Summer 2017 & M&S until Autumn/Winter 2017. To protect prices from further fluctuations and upcoming changes to trading regulations, there has even been mention of making clothes in UK again by retailers, this is a strategy which is under consideration even by retailers as large as M&S. The patriotic feelings evoked by the referendum, could help with marketing of British made clothing ranges.

The UK produces 15% of fresh fruit eaten here and 55% of vegetables; 60% of all food eaten is produced here – the remainder is imported, with the fall in the pound, all imports became more expensive. As reduction of waste and reducing the carbon footprint of food are trends within the grocery market, this is a great opportunity to increase British production of food, which, in turn, could help increase export volumes.

Exports

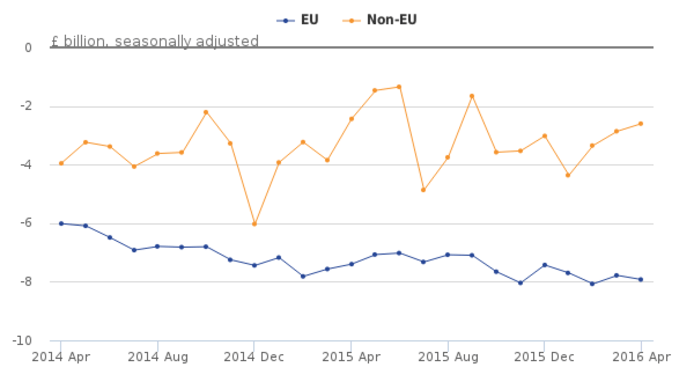

At present, all trade between the UK and EU countries is tariff and quota free though soon the UK will need to negotiate new trade agreements with the EU as a whole. The UK export market is particularly attractive due to the fall in value of the pound and an air of volatility and uncertainty; this gives the UK a positive outlook when seeking new deals with EU or non-EU countries over the forthcoming months and years. In fact, between March and April 2016 total exports grew by £2.3bn to £44.9bn (5.3%) which is the largest percentage growth since February 2010. The current market will be of interest to the World Trade Organisation, as the UK begins to carve new agreements for worldwide trade in line with UK industry and business demands, alleviating fears and concerns.

With employment at its highest level since 1973, the UK is in a strong position leading into the inevitable change over the forthcoming years.

Businesses Remaining

George Osbourne has thrown a bargaining chip into the mix to encourage multinational businesses to remain in the UK with proposals to reduce Corporation Tax to 15%, alleviating concerns around potentially increased costs. Virgin have vowed to remain in the UK, despite announcing that a third of their value had been lost due to Brexit, risking 3,000 jobs after a Chinese investor backed out of a key business deal. Similarly, Rolls Royce have solid UK foundations as well as Legal & General who have removed risks from their business in order to remain in the UK which will bring comfort to many. Of course, the car manufacturing industry is of key importance as the UK exports as much as 77% of its car output, 57% of which goes to Europe. As long as investment continues, manufacturers such as Nissan and Ford have suggested they will retain their UK operations. With concerns about potential loss of the “banking passport”, RBS CEO, McEwan has suggested that only a small number of colleagues may be moved overseas, retaining a UK & Ireland focus.

Businesses Leaving

Financial services may be the hardest hit should the UK lose the “banking passport”, allowing banking across countries without boundaries. Morgan Stanley and HSBC have suggested they may be forced to move roughly a thousand employees elsewhere in Europe. The construction industry has also seen a decline as financial data company ‘Markit’ report their construction Purchasing Managers’ Index declined to 46.0 in June from 51.2 in May, reaching its lowest level since June 2009 following the loss of investments.

The London Stock Exchange is passing through the merger approvals regulations at the moment, as Deutsche Boerse are positioned to takeover. The deal was agreed in March and confirmed it would go ahead regardless of the referendum outcome. The merger was due to leave the Headquarters in London. There have been further calls for the HQ to be in Deutsche Boerse’s Frankfurt base, but no confirmation of this will be forthcoming until the deal is voted upon by shareholders by 26th July.

Lush has chosen to move the majority of its manufacturing and supply work to their German factory. The company is also offering any of their EU workers who wish to relocate a job over there. The production of their products for the UK market will still take place in UK, and their German operation will be responsible for their other European and worldwide stock.

CEO of easyJet Caroline McCall has begun preparations to move their legal HQ elsewhere in Europe in order to retain all current operations across Europe. This potentially risks 1,000 employees at their current Luton based HQ. Meanwhile, Vodafone have suggested similar steps to remain in the single market. The single market is of key importance to all UK based international companies, and is likely to be high on the agenda when negotiating with the EU upon leaving.

Employment

With employment at its highest level since 1973, the UK is in a strong position leading into the inevitable change over the forthcoming years. There are fears surrounding workforce skill shortages especially within manufacturing, where 292,000 workers are from the EU. Similarly, 230,000 EU workers are employed within retail and wholesale – a staggering figure. Insecurity of EU worker’s status may pose complex issues for such industries relying heavily upon an EU wide workforce. However, with MPs supporting a proposal that all EU migrants remain in the UK if they choose to, the reassurance many wanted about the position of these workers seems much more secure now.

Wages & Taxes

The number of permanent recruitments prior to the referendum declined for the first time in 45 months; the hiring of temporary or agency workers during the interim may artificially drive wage growth for a few months. Plans to increase real wages through implementation of the National Living Wage reaching over £9 per hour may be threatened. However, demand for some roles may be heightened by skill shortages and may cause a real wage hike.

There has been much speculation regarding taxes; the Chancellor not issuing a Brexit budget means there are currently no plans to change tax rates. Changes to personal taxes are likely to change, but until a new Prime Minister is in charge the change cannot easily be predicted. The passing of a few months and calming of the international markets will give the new Prime Minister a much clearer vision on how to reshape the country’s finances.

Opportunities

As made clear above, there are many uncertainties about what will happen in a post-EU UK, which is causing fear in many different areas. There are definite opportunities which can be taken advantage of now, as well as in the years to come, which can provide reassurance to many:

- Access to free market – It’s an appealing time for other countries to purchase goods and services with the low value of the pound. This can launch a good platform for UK sales.

- The cost of food and other goods may decrease, should the UK be able to reach suitable agreements to import products at a reasonable price.

- Possibility of creating our own migration policy, supporting UK population as well as UK businesses, in the aim to become an extremely competitive producer.

- Potential to revitalise lost industries such as fisheries and steel production. Manufacturing of clothing may also return to Britain, as hinted by M&S.

- Companies offering financial advice and services can expect an increase in demand to advise on potential economic impacts of Brexit.

- First time buyers benefit from falling house prices – foreign banks, particularly a Singapore bank, refusing to lend for London properties, bringing down house prices due to falling overseas demand.

- Long term benefits – the opportunity to discuss access to EU single market – once the decision is made, certainty and stability have the potential to follow.

- Reduced spend on EU budget – This spend needs to be re-directed to achieve economic constancy and invigorate growth.

- Retailers trading in different currencies (US & EU countries) can increase their profits with sales in those markets.

What we know for sure at SWL…Despite the uncertainty ahead for retailers, there is still the need to keep on trading effectively. Therefore, adapting to this emerging and developing trading environment, with a focus on what’s within their sphere of influence has become vital. Just as the UK economy is changing to face challenges ahead with future years of reform, retailers must take the opportunity now to ensure that their businesses are adaptive & strong for this new UK/European reality.

SWL’s Productivity Situational Studies address retailer’s operations from the ground up enabling clear sight of the AS IS situation, providing a robust base for future stability & growth.

Get in touch with us to find out more.